Many people believe that an innovation will sell itself; that if they present a solution that is well crafted, brimming with features and solves the problem they have identified, then they will enjoy success. But catering to unmet customer needs, while potentially lucrative, is nowhere near as simple as just presenting buyers with something new.

Why do customer needs go unmet?

Customer needs go unmet for three key reasons. The need may exist but no-one has presented customers with a solution they want to buy. A solution is available but customers don’t see or believe they have a need that needs meeting. A solution is available but customers are not willing to commit to resolving that need because they do not want to commit to the technology and/or the risks.

Despite this, unmet customer needs may be difficult – even counter-intuitive – to identify because people don’t know what they don’t know and find it hard to articulate what they don’t know they can have. However, unmet needs represent powerful opportunities for brands to build their current market share, disrupt their own or an adjacent market, and maximise investments by enabling current products to be reviewed and optimised.

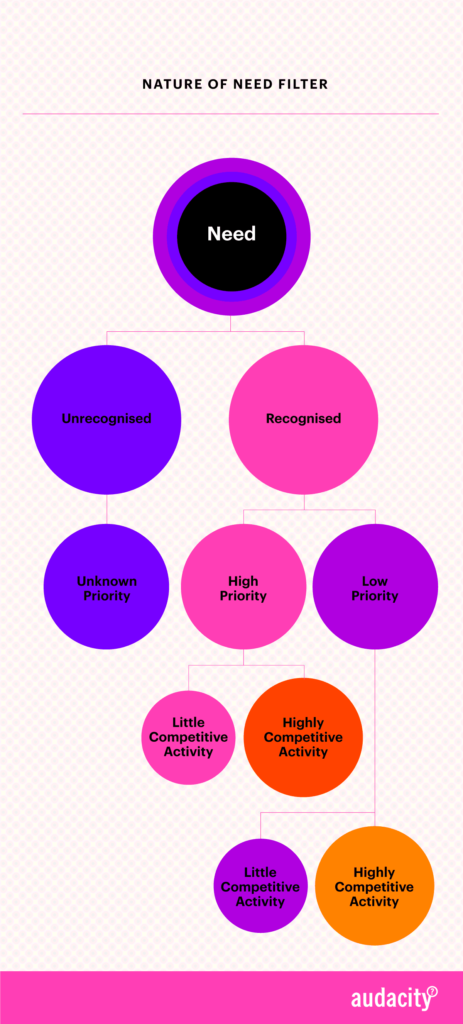

The whole purpose of a brand is to meet a need in a distinctive way. So for marketers and business leaders, tying brand to need is a critical equation. In the Brand Definition Funnel, we identify three types of need: unmet or unrecognised need; existing needs that are well catered for; and needs that are present but are low priority.

Establishing the type of need you are catering to is the first step

Establishing the type of need you are catering to is the first step

in Audacity Group’s Brand Definition Funnel.

For many marketers, meeting an unmet customer need is the “holy Grail” of marketing because it represents discovering something that others haven’t seen and that the world embraces with open arms. But there can be reasons why a need goes unmet – and it’s not always linked to going unrecognised. Sometimes, there is a need that has already been identified, but not enough volume or capital back-up to make commercialisation feasible.

There is no single rate of take-up

One of the key learnings from this visualisation of how people adopt technology is that there is no uniform take-up speed for any idea. Some technologies get taken up very quickly; others take generations to become accepted – and many will either not take off or fade long before they get to viability.

The temptation when an idea fails to fire immediately is to see it as “ahead of its time”. But, as this article explains, that assumes that adoption is chronological and progressive – and that an idea has a time, it just needs people to reach that point. Instead, customers’ ability to adopt new ideas to meet their historically unmet needs often depends on a combination of psychology and sociology – how they feel and how others around them are reacting or might react.

The other complication with unmet customer needs is that they have no current priority status with customers. Unlike known customer needs, where a marketer can distinguish between those products that deliver on a highly valued need and those that need to gain attention in spite of being low priority needs, an unmet customer need has no standing in customers’ lives because of course they don’t know they need it. To help overcome this, we often start by looking to link the unmet need to the closest known customer need we can identify. That at least starts to give us some sense of whether this is something that will be front-of-mind for customers or whether we will need to convince them to make this something they give time to.

Identifying unmet customer needs

Marketers would like to believe that unmet customer needs can be found with a little digging. Look for things that don’t work well, or that could work better; or find examples of where people can’t get what they want or they are using something else because that’s the closest thing they can find. Then answer that need – and ask customers what they think.

But establishing a truly unmet customer need is difficult because, as Alex Gilev points out, what people say they need or want is often not what they actually need. Taking statements of customer intent or even belief at face value can be misleading. We know this already about what people say about their uptake of sustainable brands for example. A popular statistic is that 87% of consumers would prefer to buy environmentally responsible products. Buying patterns don’t support that happening.

Gilev cites the example of Walmart conducting a survey that asked customers, “Would you like Walmart aisles to be less cluttered?”. They got an overwhelmingly positive response. So Walmart cleared the space and reduced their inventory. Two things happened. Customer satisfaction, as measured by a customer survey, went up – and sales went through the floor. Which just goes to show that while customers may think they know what they want, and therefore that they can recognise an unmet need, when it comes time to act on that need, they fail to do so.

Surveys and focus groups don’t work

Gilev gives a number of reasons as to why you can’t depend on customers to help identify unmet customer needs. Surveys and focus groups in particular don’t work, he says, because people are not always aware of the true reasons they make decisions and they articulate beliefs based on peer approval rather than what they actually believe.

Part of the vulnerability of surveys and focus groups is the mechanism itself. People come together in a small setting for a small amount of time to discuss something they are unfamiliar with. The setting itself therefore is inherently low-trust unless skillfully handled. People are acutely self-conscious in such a situation and that in itself will tempt them to search for consensus with the rest of the group. People also bring their emotions to their judgments. A bad day, for example, can translate to disinterest or indifference.

To overcome this, Gilev suggests that watching how people act, rather than asking them what they think, is the key to success. Focus on two things, he suggests: why they want something; and the emotion they are most looking for. People are driven by outcomes not products – and therefore understanding what they do to complete a current task and how they feel about that is critical to identifying where unmet customer needs truly lie.

How Walmart met a need and lost a fortune

The problem with the Walmart approach was that they market-researched the answer rather than investigating the need. They presented customers with a thesis rather than observing what they were truly looking for. Because people are inclined to agree, the retailer ended up with a very expensive false positive.

The other key problem was that the answer itself fought with Walmart’s own brand codes. The attraction of the Walmart brand is that consumers have access to a wide range of options at affordable prices. That is the basis for the decision to choose the Walmart shopping environment. When Walmart removed so many of their choices, two conflicting things happened: customers enjoyed the more open, less cluttered environment and, at exactly the same time, they were frustrated that they had so many fewer options to choose from. The findings reflect that perfectly. Asked “What do you think of our new environment?”, people responded positively. But when it came to actual shopping, they stopped buying to the tune of $1.85 billion.

The new and improved Walmart was not the Walmart they knew. And that’s the danger of forming a thesis about what customers would “really” want. A perceived customer need for more space should indeed have gone unmet because it was not something that customers wanted at all.

Testing the business case of a customer need

- What is the basis for identifying the unmet customer need? Observation is the most powerful way to find a need that is not being met. But once an unmet customer need is identified, the branded solution must have a rapid pay-back time. Customers will want to see the advantages of choosing to meet this unmet need both quickly and socially. Does it do something new quickly and easily? And can people share the unmet need and its solution with the people they know in ways that are prestigious and engaging? Selfies didn’t just give people a new way to capture their lives, they also presented new opportunities for people to share (and compare) their lives with others.

- How valuable and relevant is the unmet customer need? Of course customer needs and attitudes change over time in keeping with new findings and the new acceptance of ideas that would once have been foreign. New needs can also emerge for a range of reasons including new social settings, different economic pressures and/or changes in expectation, prestige and/or convenience. But why does this previously unmet need to be fulfilled now? And why is whatever is being proposed a better way to fulfil that new need than anything that is currently available?

What will customers themselves think?

- Will people recognise and prioritise the new need? Fulfilling a new and unmet need can take place in many ways. It may for example involve replacing an historic need with a new one. (Social media for example globalised our need for social interaction) Or it may ask people to add another need to the needs they feel they already have. Either way, it’s important to look at how well the previously unmet need fits with what people already know and relate to: their value and belief systems, for example, their available income and the things they are already used to doing.

- Does the unmet customer need fit with the brand it is being associated with? People gravitate to brands because of expectations built over time. If the new customer need though is not compatible in the minds of customers with the brand delivering it, then both the “solution” and the brand will suffer. As the Walmart example shows, people won’t take up the idea, even if they say they like it, because it doesn’t meld with what they have come to expect. Equally though, brands that don’t adapt to changing and unmet customer needs may find themselves cast aside in favour of new favourite brands that customers now feel more at home with.

Will this be hard to bring to market?

- Will meeting this unmet customer need be hard? If answering the need is more difficult than ignoring it, people may just look for a work-around or they may choose to delay incorporating that need (and therefore the brand) into their lives.

- How easily can people come to accept the need for themselves? An unmet need will become recognised and accepted more quickly if people can take it up without any risk. In other words, needs are not something people are told about. They become something that people take ownership of. They can do it for free or in a limited amount first before they commit more fully.

16 ways to find an answer

When we look at how to resolve an unmet customer need, there are four immediate options:

- A new product or service that achieves something for the first time

- New ways of doing what people know how to do, that redefines what was familiar

- Introducing a new emotion that changes how people feel about something they have to do

- Some combination of the above

Inspired by this Hubspot list, here are 16 ways you can look to meet an unmet customer need once you know what it is:

- Give customers the opportunity to create changes that work for them

- Re-set the way a current answer works

- Alter what customers pay

- Reinvigorate what people feel about doing something

- Add to what else is available

- Increase where, how or when customers access an answer

- Offer a different and better experience

- Redesign a solution

- Lift how reliable the solution is

- Change what the product or service does

- Shift the time something takes

- Rethink how something can combine with other products to solve a problem neither could fix on their own

- Lift what something means to someone – by elevating its need status (think Maslow’s hierarchy of needs)

- Adjust how people can interact with the brand – and what happens when they do

- Intensify what the customer controls – for the better

- Accelerate decision making by making it easier, faster, more valuable and/or more personal

Selling new answers in a B2B setting

The messages in B2B settings in particular can be confusing for brands looking to deliver solutions to unmet customer needs. When Thomas Steenburgh and Michael Ahearne looked at the challenges companies faced in bringing new products to market, they found it placed particular pressures on sales teams.

The authors wanted to see which parts of the sales process represented the greatest barriers to bringing new products to market. So they investigated the dynamics of six different stages of the sell-in:

(1) sales inquiry, when someone makes an initial call;

(2) needs recognition, when the salesperson helps the customer better understand his or her needs;

(3) evaluation, when the customer begins to consider various products;

(4) solution development, when the customer sits down with a limited set of suppliers and works out potential solutions;

(5) decision, when the customer decides whether or not to buy; and

(6) after-sale maintenance, which takes place after the customer buys the product.

They found that overall new products were much more time consuming to introduce to a market. Salespeople spent 35% more time meeting with customers than they do when selling an established good or service. There were more meetings to educate customers and decision makers on why and how the new product will change their current business practices. They also spent 30% more time meeting with cross-functional teams to achieve the broader consensus required to get the new product onboard.

New ideas generate different concerns

The greatest resistance typically occurred later in the sales process than it did for established products. People want to hear more about a new idea to stay current with what is happening around them. They become more reluctant to commit as the process edges closer to commitment and customers think about abandoning what they are already familiar with.

Objections in the early stages of the sales process revolved around limitations. There were calls for more evidence about the new need and how the product will address it. Some felt their product already did enough to deal with the unmet customer need.

By the solution-development stage, however, customers focused on how a proposed solution will change their established business practices. They worried about things like disruption and personal repercussions. By the decision stage, those concerns revolve around perceptions of risk and how a decision could affect and involve others. Some worried they may miss out on an opportunity. Equally, they didn’t want to associate themselves with something that didn’t work. They questioned the extent and predictability of the investment and pay-off.

This led to frustrating patterns of interest and then fall-off: “[Salespeople] are getting in front of customers and creating relationships with prospects who previously might not have taken their calls … But as the process unfolds, it becomes clear that many of those curiosity-driven meetings were never real opportunities”

How B2B brands can better resolve unmet customer needs

Thomas Steenburgh and Michael Ahearne’s findings point to a range of initiatives that B2B brands can take. Here are their four ways to uncover, address and resolve unmet customer needs:

- Work with clients to find critical moments of failure, and then work through what did or didn’t happen.

- Look at what competitors have done that worked. Are there implications from that success that point to your competitors meeting or only partially meeting a customer need?

- Agree on challenges that you and your customer can work on together. Rather than presenting a client with a new product, perhaps start by identifying an agreed difficulty. That could, in turn, point to an unmet customer need.

- If you already have a relationship with the brand, start by talking with those people who work directly with customers. Find out what customers are saying. Then look to escalate problems and possible solutions from there. That way, you are working from within the organisation to provide a known and provable solution.

Part of our Brand Definition Funnel

Establishing the type of need you are catering to is the first step in Audacity Group’s Brand Definition Funnel. We’ve designed this simplifying tool to help senior marketers sort the five defining elements of your brand. You will then be ready to approach the intricacies of your brand strategy with a clear big picture view. Read more.